Trade Tax Calculation

- Tax Base: The tax base is determined by the business’s profit, calculated from the annual profit and loss statement.

- Base Tax Rate: A uniform base tax rate of 3.5% is applied to the tax base.

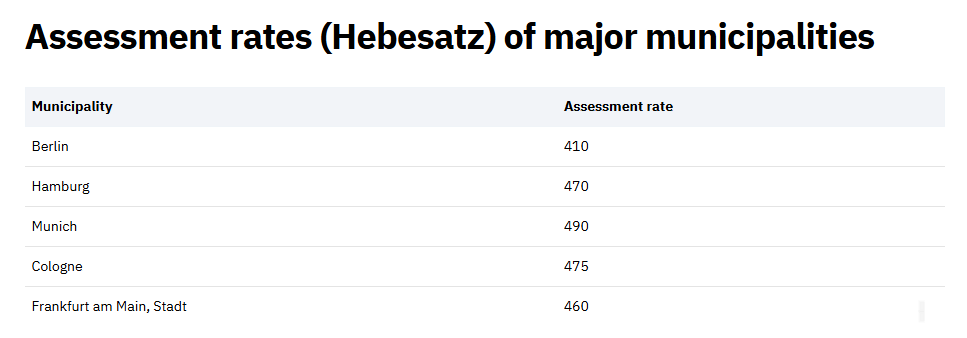

- Municipal Multiplier (Hebesatz): Each municipality sets its multiplier, which varies significantly across the country. This multiplier is applied to the base tax amount to determine the final trade tax due.