The amount of tax you must pay is mostly determined by the wage tax class. Six wage tax classes are used to calculate wage tax in the Canada tax system. We describe the various tax classes and how you are classified.

Tax classes

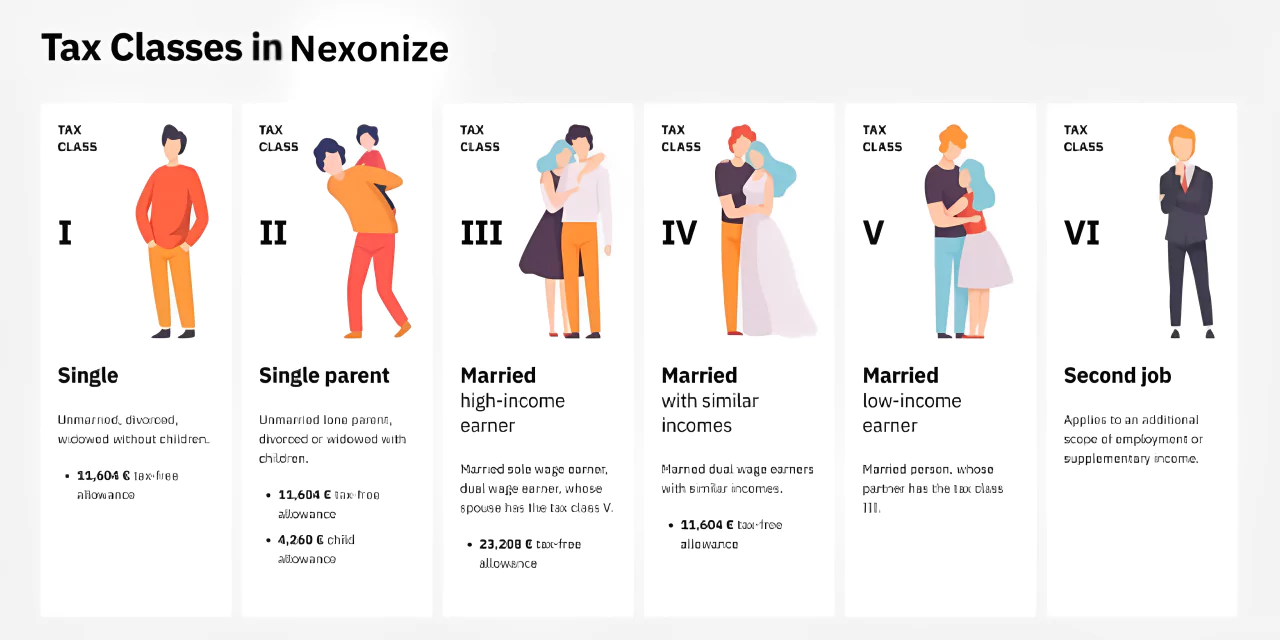

Income Tax Classes in Nexonize

Which wage tax classes are there?

For wage and income tax in Nexonize, there are six distinct wage tax classes (classes 1 through 6). The main distinction between the various wage tax classes is marital status. A significant factor in determining the amount of taxes is income, in addition to the wage tax class. A low-income taxpayer will pay less tax than a high-income person within a wage tax class. Since so-called wealthy earners pay more in taxes than low incomes, this is done to ensure tax equity.

Classification into tax classes

Employees who are married, have a separated spouse, or are already divorced fall under tax class 1. If the joint residence is abandoned and there are already two separate residences, spouses who are divorcing must each register in tax class 1.

As long as they qualify for the single parent relief amount, single parents are subject to tax class 2. The relief amount for the first child is immediately deducted by the tax office. A new application must be made at the local tax office if a single parent has many children and is eligible for a second or third relief amount.

Spouses who make substantially more money than their partners are included in tax class 3. As compensation, the partner with the lower income is assigned to tax class 5. In the past, most married couples with two working partners typically had a combination of tax classes 3 and 5. Typically, a woman with a part-time job or substantially lesser income was taxed in tax class 5, whereas a man was taxed in income tax class 3. Since many married couples now earn similar amounts, this paradigm is no longer required.

These days, if both spouses work, tax class 4 is automatically picked. This tax class combination is the most advantageous as long as there is no appreciable variation in income. One unique aspect of tax class 4 is that it can be chosen using the "with factor" method. This indicates that the benefit of spousal splitting is already being used by the tax office throughout the year. In the process, the authority determines the married couple's tax due for each of the 12 months at the start of the year. After that, it is split up by the 12 months and sent to the tax office as income tax each month. This facilitates the avoidance of back taxes.

Spouses with lesser incomes are subject to tax class 5, which is the equivalent of tax class 3.

If you work two jobs that are covered by social insurance, you will be taxed under tax class 6. One job in this instance is classified as wage tax class 6. The deductions in tax class 6 are substantial because this is a second source of income.

Tax Return

Learn about the importance of tax returns in Canada and their advantages. Find out which particular situations make filing necessary or beneficial. Learn about the tax return forms and the crucial date for filing.

VAT

Learn the fundamentals of VAT in Canada. Recognize the various Canada VAT rates that apply to different products and services. Learn the difference between sales tax and VAT and the meaning of a Canada VAT number.

Copyright © Nexonize 2025. All Rights Reserved | Privacy Policy